FY25 Compact SUV Sales: Tata Punch Beats Brezza, Fronx & Nexon in a Tight Race

Tata Punch Takes the Crown in FY25

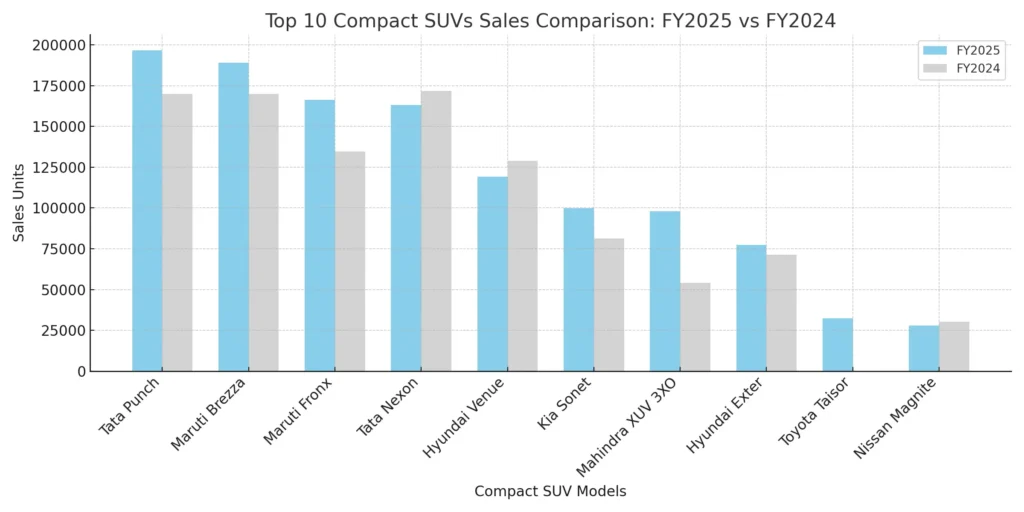

Tata Motors has clinched the top spot in the compact SUV segment for FY25 with the Punch. With total sales of 1,96,572 units, it saw a 16% increase over its FY24 numbers. The Punch’s consistent performance and value-for-money proposition continue to attract Indian buyers looking for an urban-friendly SUV.

Its accessible pricing and feature list have kept it ahead of rivals, even as the competition heats up. Tata’s aggressive marketing and updates have helped sustain its popularity.

Brezza & Fronx Hold Strong for Maruti Suzuki

Maruti Suzuki secured second and third positions with the Brezza and Fronx respectively. The Brezza saw an 11% YoY rise, touching 1,89,163 units in FY25. While it missed the top spot, it still held firm with dependable sales.

The Fronx, on the other hand, had a breakout year. With 1,66,216 units sold, it grew by 23%, the highest among the top five. Its unique SUV-coupe design and Nexa showroom push have made it a hit among younger buyers.

Nexon & Venue See Declines Despite Popularity

Despite being a market leader in previous years, Tata Nexon dropped to the fourth spot. It registered a 5% YoY decline, finishing FY25 with 1,63,088 units. A mid-life refresh might be needed to regain momentum.

Hyundai Venue also witnessed a drop, falling by 8% to 1,19,113 units. The increasing competition in the segment and the lack of a major update seem to have affected its performance.

Kia Sonet & Mahindra XUV 3XO Post Strong Gains

The Kia Sonet delivered solid numbers with 99,805 units, registering a 23% growth over FY24. Its wide variant spread and feature-rich package continue to attract buyers.

Meanwhile, Mahindra’s XUV 3XO had a remarkable 82% growth, jumping from 53,962 units to 98,091. The new updates and focus on tech-driven features have clearly paid off.

Exter, Taisor & Magnite Round Out the List

Hyundai Exter posted a 9% YoY growth to reach 77,412 units, maintaining a steady demand. Toyota Taisor, in its first fiscal year, recorded 32,378 units and secured ninth place.

The Nissan Magnite, however, saw an 8% decline with 27,884 units, pushing it to the tenth spot. Without major updates, it struggled to keep pace with newer rivals.

What This Means for Buyers

The FY25 data signals a shift in buyer preferences toward fresher designs, connected features, and strong brand value. Tata Punch and Fronx lead in appeal and performance, while XUV 3XO has become a surprise contender.

For buyers, this evolving segment means more choices than ever before. But as sales patterns show, newer models and consistent updates are what truly keep a compact SUV relevant in today’s fast-moving market.