Car Retail Sales October 2025: Festive Surge Pushes Maruti, Tata, Mahindra to Record Highs

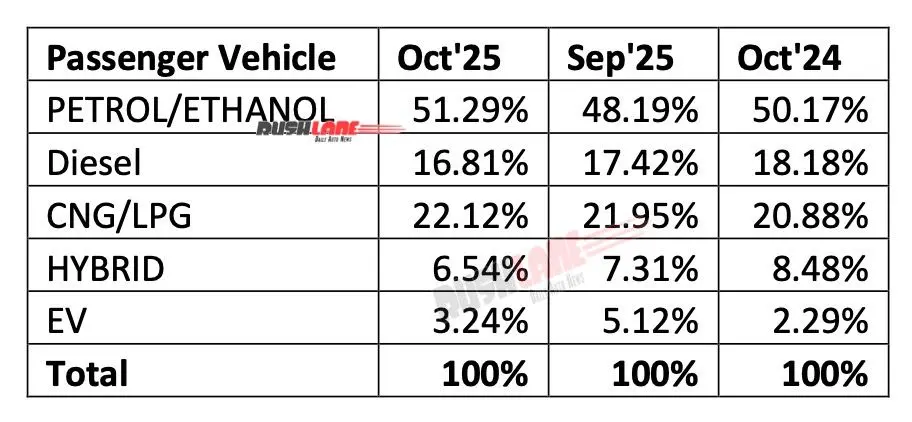

India’s auto industry recorded a blockbuster October as festive demand, new GST benefits, and fresh launches pushed car sales to record highs. According to FADA’s October 2025 retail report, total vehicle sales grew 40.5 per cent year on year, with car sales up 11.35 per cent. The revised GST structure, effective from September 22, combined with aggressive festive discounts, drove buyers to showrooms in record numbers.

Record-Breaking Month for India’s Auto Industry

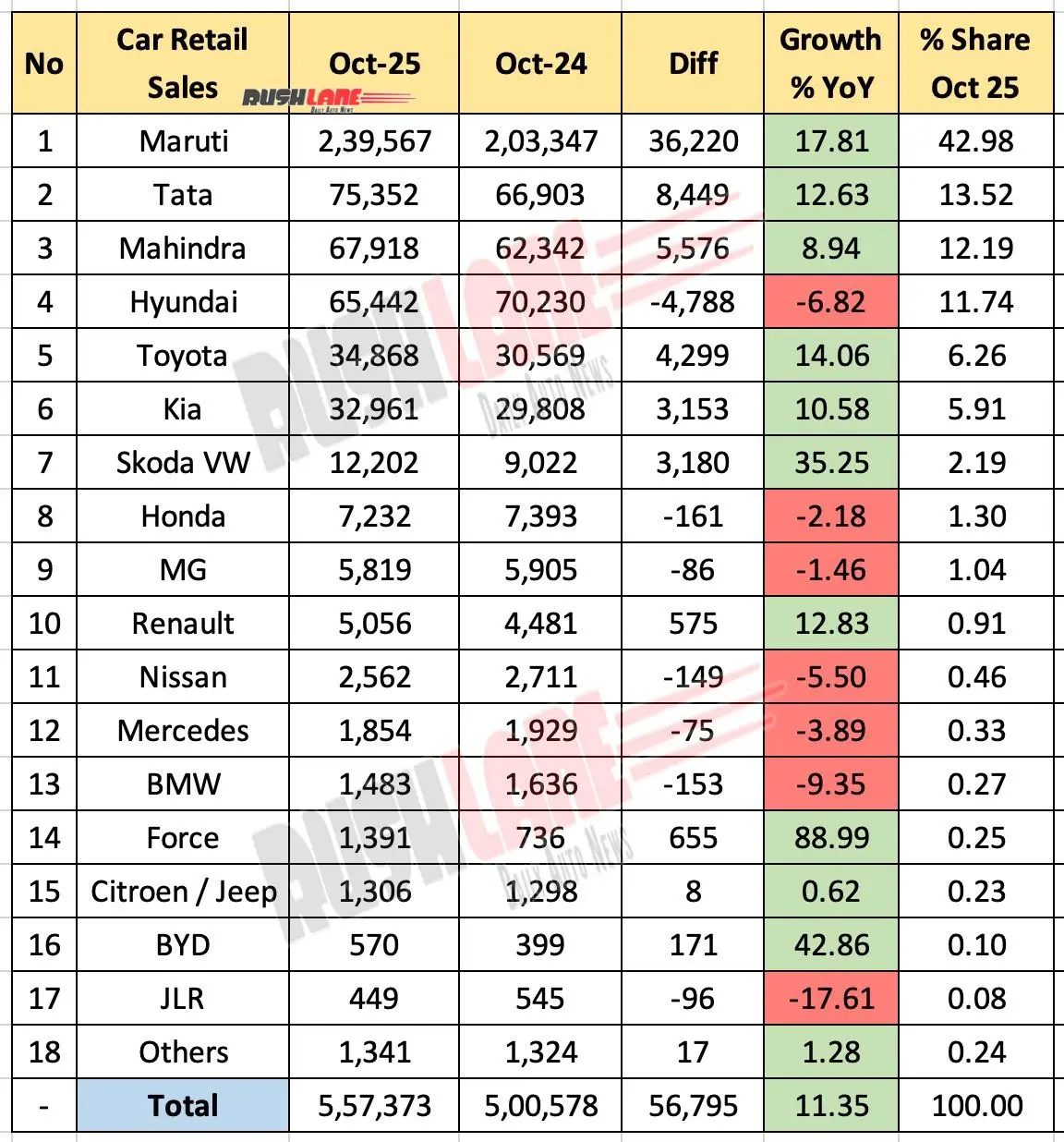

October 2025 emerged as one of the strongest months for India’s auto retail sector. Dealers reported heavy footfall across the country as lower taxes and exchange schemes encouraged customer spending. Car sales climbed to 5,57,373 units, up from 5,00,578 units in October 2024, while month-on-month growth surged over 86 per cent compared to September 2025. The market’s performance reflected the combined impact of fiscal reforms and festive enthusiasm.

Maruti Leads, Tata Holds, Mahindra Gains

Maruti Suzuki maintained its dominant lead with 2,39,567 units sold in October 2025, up from 2,03,347 units a year earlier, giving it a 42.98 per cent market share. The brand’s compact and UV lineups remained its strongest performers. Tata Motors secured second place with 75,352 units, rising from 66,903 units and holding a 13.52 per cent share. Mahindra followed with 67,918 units, growing year on year but slightly lowering its share to 12.19 per cent amid strong competition.

Hyundai and Toyota See Mixed Results

Hyundai faced a modest decline, selling 65,442 units compared to 70,230 a year earlier. In contrast, Toyota advanced to 34,868 units from 30,569 in October 2024, boosted by growing hybrid SUV sales. Kia India also recorded growth, reaching 32,961 units versus 29,808 previously. Hyundai’s dip reflects product cycle shifts, while Toyota and Kia continue to benefit from their renewed SUV portfolios.

VW Group, Honda, and MG Hold Ground

The Skoda VW Group posted strong gains with 12,202 units, up from 9,022, driven by the success of the Kushaq and Taigun. Honda Cars saw a slight fall to 7,232 units from 7,393, while MG Motor slipped to 5,819 from 5,905. Renault reported 5,056 units compared to 4,481 in the previous year, gearing up for the 2026 Duster relaunch. These mid-tier brands continue to maintain stability within a market dominated by larger players.

Luxury Segment Faces a Festive Slowdown

The luxury car segment showed a contrasting trend. Mercedes-Benz sales fell to 1,854 units from 1,929, while BMW delivered 1,483 units compared to 1,636 a year earlier. Jaguar Land Rover registered an 18 per cent decline to 449 units. The slowdown reflected limited festive incentives and inventory adjustments ahead of the 2026 model year introductions.

The Road Ahead

October’s results underline the strength of India’s festive season and the positive effect of the new tax policy on consumer confidence. With overall vehicle sales at an all-time high and strong dealer sentiment, the final quarter of FY25 is expected to sustain this momentum. As automakers prepare for Diwali-driven demand in November, the Indian car market looks set to close 2025 on a record-breaking high, reaffirming its position as one of the world’s fastest-growing automotive markets.