Bike Sales October 2025 India: Hero and Honda Dominate, Ather Surges Past Ola

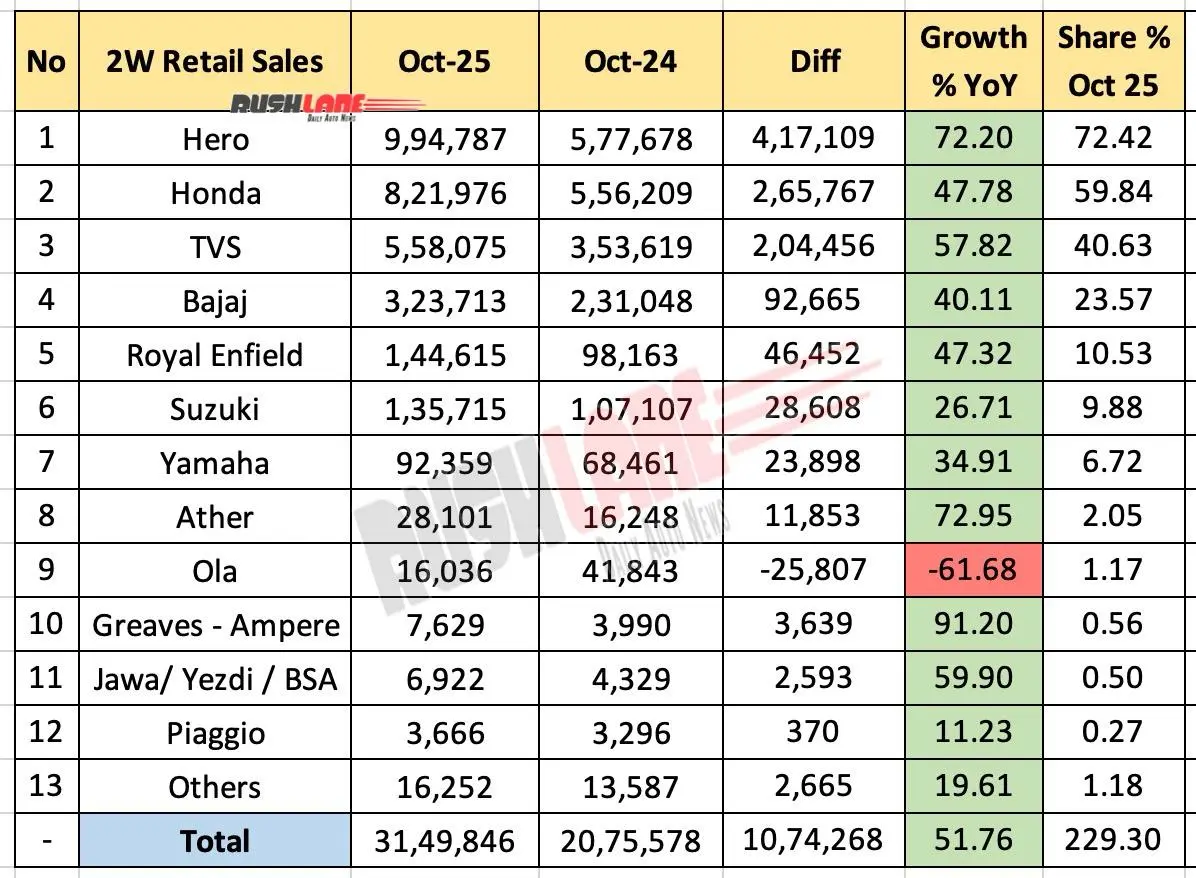

India’s two-wheeler industry reached an all-time high in October 2025, with retail sales crossing 31.5 lakh units. It marked a 51.7 per cent year-on-year growth driven by GST 2.0 tax reforms, a record festive season, and a resurgence in rural demand. From Hero and Honda’s dominance to Ather overtaking Ola in the EV race, October was a milestone month that reflected both policy impact and consumer confidence.

Festive Rush and Policy Boost

The Dussehra–Diwali overlap created the perfect demand storm for bike makers. GST 2.0 reforms reduced tax rates on entry-level two-wheelers, improving affordability and encouraging first-time buyers. Rural liquidity, improved monsoon output, and government-led infrastructure spending further fueled optimism, making this the best festive season in years for dealers nationwide.

Hero and Honda Take the Lead

Hero MotoCorp maintained its lead with nearly 9.95 lakh retail sales and a 31.5 per cent market share. Its wide rural reach and popular commuter range, including the Splendor and Passion, continued to drive momentum. Honda followed closely with 8.22 lakh units, led by the Activa scooter range and strong motorcycle sales like the Shine and Unicorn. Together, the two brands accounted for more than half of India’s total two-wheeler sales last month.

TVS and Bajaj Maintain Momentum

TVS achieved record performance with 5.5 lakh units, powered by the Apache and Jupiter range. Its iQube EV also saw its best month yet. Bajaj recorded 3.23 lakh retail units, with exports and the Pulsar portfolio keeping volumes strong. Although Bajaj’s market share dipped slightly, anticipation around the next-gen Chetak continues to build excitement in the market.

Royal Enfield and Suzuki Build Strength

Royal Enfield posted 1.44 lakh units, up from 98,000 a year ago, supported by the Hunter 350 and the new Bullet 350. Suzuki delivered 1.35 lakh units, its highest ever, thanks to solid performance from the Access 125 and Burgman Street. Both brands benefited from urban and aspirational buyers looking for premium yet practical motorcycles.

EV Segment Shifts — Ather Overtakes Ola

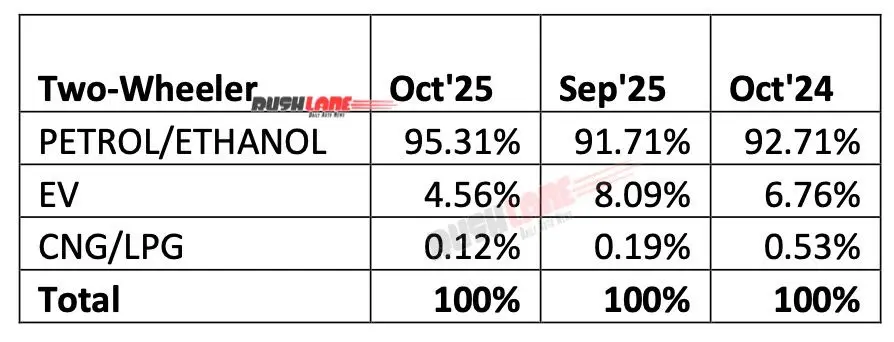

The electric two-wheeler space saw a major shakeup. Ather recorded 92,359 units, overtaking Ola Electric, which slipped to just 16,036 units from over 41,000 a year ago. The shift highlights growing trust in Ather’s dealer network and quality focus. Despite this, EV share in the overall 2W market dropped to 4.5 per cent from 6.7 per cent as affordable ICE models drew festive buyers.

Rural India Leads the Charge

FADA data shows rural two-wheeler demand nearly doubled urban growth. Strong farm income, festive bonuses, and easier financing options made Bharat the key growth driver for October’s record sales. Rural dealerships reported improved cash flows and consistent footfall throughout the 42-day festive window.

Outlook: Full Throttle into 2026

The momentum is expected to continue through early 2026. GST benefits, marriage season demand, and rising liquidity are set to sustain growth. With Hero and Honda reinforcing their dominance and Ather leading EV momentum, India’s two-wheeler industry appears well-positioned for another year of expansion.